What Is True Of The M1 Category Of Money Quizlet

Chart showing the log of the velocity (light-green) of the U.S. M2,[1] [two] calculated by dividing nominal GDP by the M2 stock (M1 plus time deposits), 1959–2010. The employment-to-population ratio is displayed in bluish, and periods of recession are represented with gray bars.

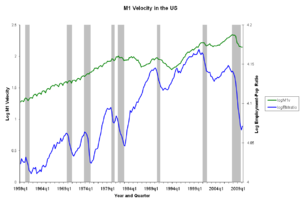

Similar chart showing the logged velocity (greenish) of a slightly narrower measure M1 of money consisting of currency and liquid deposits, 1959–2010.

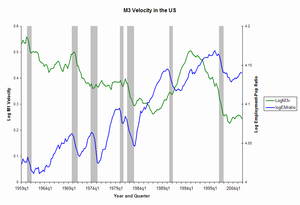

Similar nautical chart showing the logged velocity (green) of a broader mensurate of money M3 that covers M2 plus large institutional deposits. The US no longer publishes official M3 measures, then the nautical chart only runs through 2005.

The velocity of coin is a measure out of the number of times that the average unit of currency is used to buy appurtenances and services within a given time catamenia.[3] The concept relates the size of economic activeness to a given money supply, and the speed of money exchange is ane of the variables that decide inflation. The measure of the velocity of coin is commonly the ratio of the gross national production (GNP) to a land'due south money supply.

If the velocity of money is increasing, and then transactions are occurring between individuals more often.[3] The velocity of money changes over time and is influenced by a variety of factors.[iv]

Illustration [edit]

If, for instance, in a very small economic system, a farmer and a mechanic, with merely $l between them, buy new goods and services from each other in only three transactions over the course of a year

- A farmer spends $50 on tractor repair from a mechanic.

- The mechanic buys $40 of corn from the farmer.

- The mechanic spends $ten on barn cats from the farmer.

so $100 inverse hands in the course of a year, even though at that place is only $50 in this fiddling economy. That $100 level is possible considering each dollar was spent on new goods and services an average of twice a yr, which is to say that the velocity was . Note that if the farmer bought a used tractor from the mechanic or made a gift to the mechanic, it would not go into the numerator of velocity because that transaction would non be function of this tiny economy's gross domestic production (Gross domestic product).

Relation to money demand [edit]

The velocity of money provides another perspective on money need. Given the nominal menses of transactions using money, if the interest rate on alternative financial assets is loftier, people will not want to agree much money relative to the quantity of their transactions—they effort to exchange it fast for goods or other financial assets, and money is said to "burn a hole in their pocket" and velocity is loftier. This situation is precisely one of coin demand existence low. Conversely, with a low opportunity cost velocity is low and money demand is high. Both situations contribute to the time-varying nature of the coin need.[5] In money market place equilibrium, some economic variables (interest rates, income, or the price level) have adjusted to equate money demand and coin supply.[ commendation needed ]

The quantitative relation between velocity and money demand is given by Velocity = Nominal Transactions (however divers) divided by Nominal Money Demand.

Indirect measurement [edit]

In practice, attempts to measure the velocity of money are usually indirect. The transactions velocity can exist computed as

where

- is the velocity of money for all transactions in a given fourth dimension frame;

- is the price level;

- is the aggregate real value of transactions in a given time frame; and

- is the total nominal corporeality of money in circulation on boilerplate in the economy (see "Money supply" for details).

Thus is the total nominal amount of transactions per period.

Values of and permit calculation of .

Similarly, the income velocity of money may be written as

where

- is the velocity for transactions counting towards national or domestic product;

- is an index of real expenditures (on newly produced appurtenances and services); and

- is nominal national or domestic product.

Determination [edit]

The determinants and consistent stability of the velocity of money are a subject of controversy across and within schools of economical thought. Those favoring a quantity theory of money have tended to believe that, in the absence of inflationary or deflationary expectations, velocity will be technologically determined and stable, and that such expectations will not generally arise without a bespeak that overall prices accept changed or volition change.

This determinant has come nether scrutiny in 2020-2021 as the levels of M1 and M2 Money Supply grow at an increasingly volatile charge per unit while Velocity of M1 and M2[3] flattens to stable new depression of a 1.10 ratio. While interest rates have remained stable under the Fed Rate, the economic system is saving more M1 and M2 rather than consuming, in the expectations that Fed benchmark interest rate increases from all-fourth dimension lows of 0.50%. During this time, inflation has risen to new decade highs without the velocity of money.

Criticism [edit]

Ludwig von Mises in a 1968 alphabetic character to Henry Hazlitt said: "The main deficiency of the velocity of circulation concept is that it does not start from the deportment of individuals but looks at the trouble from the bending of the whole economic arrangement. This concept in itself is a vicious way of approaching the problem of prices and purchasing power. It is assumed that, other things existence equal, prices must change in proportion to the changes occurring in the total supply of coin available. This is not truthful."[half dozen]

References [edit]

Notes [edit]

- ^ M2 Definition – Investopedia

- ^ M2 Money Stock – Federal Reserve Banking concern of St Louis

- ^ a b c "Money Velocity". Federal Reserve Banking concern of St. Louis. Retrieved October 28, 2013.

- ^ Mishkin, Frederic S. The Economics of Money, Banking, and Fiscal Markets. Seventh Edition. Addison–Wesley. 2004. p. 520.

- ^ Benchimol, Jonathan; Qureshi, Irfan (2020). "Time-varying money demand and existent rest furnishings" (PDF). Economical Modelling. 87 (1): 197–211. doi:ten.1016/j.econmod.2019.07.020.

- ^ Quoted in Hazlitt, Henry. 'Velocity of Apportionment' in James Muir Waller (ed.). Money, the market, and the state: economic essays in award of James Muir Waller. University of Georgia Press, 1968, p. 42.

Sources [edit]

- Cramer, J.S. "velocity of circulation", The New Palgrave: A Dictionary of Economic science (1987), five. 4, pp. 601–02.

- Friedman, Milton; "quantity theory of money", in The New Palgrave: A Dictionary of Economics (1987), v. 4, pp. 3–20.

External links [edit]

- Velocity of money data – from the St. Louis Fed's FRED database

Source: https://en.wikipedia.org/wiki/Velocity_of_money

Posted by: williamsgrothe1954.blogspot.com

0 Response to "What Is True Of The M1 Category Of Money Quizlet"

Post a Comment