How Much Money Do I Need Saved To Buy A 300k House

Home buyers oft focus simply on the down payment when information technology comes to buying a firm. Closing costs can increase the amount of cash you lot'll demand to shut. What are those fees, and how much tin you wait to pay?

Ane of the biggest shocks of buying a abode is finding out that y'all need way more cash to close on a firm than just a down payment. Information technology's hard enough to save for the down payment on your home, but to detect out that you need more than – often a lot more – in order to complete the transaction.

Let's look at how much cash it takes to actually purchase a home. And where possible, I'll suggest ways that can reduce or even eliminate the additional cash requirements.

The actual downward payment

This is the only greenbacks outlay in the dwelling house-buying process that's obvious to most buyers. It is usually expressed as a pct of the purchase price of the property. For instance, if the buy price is $200,000, and yous're required to make a 10% downwards payment, yous'll have to pay $xx,000.

That'south the like shooting fish in a barrel function.

How much practice you need for a downward payment on a house?

It varies. With most lenders, if you want to avoid paying additional individual mortgage insurance (PMI), you're looking at a xx% down payment. Simply coming up with 20% may be difficult for many start-time buyers, so mortgage lenders take options with downward payments of 10%, five%, or – if you authorize for special FHA loans or VA mortgage loans – as little as 3.5%.

This is another good reason to shop around for mortgage lenders.

Acceptable sources of funding for a downwards payment

Exactly where your downwardly payment funds come up from will depend on the type of mortgage you are applying for. In some cases, the downwards payment must come from your own funds, such equally your bank account. But in other cases, information technology tin can come from a gift or even exist borrowed from approved agencies.

Conventional and jumbo loans tend to have the strictest rules when it comes to the source of your downward payment funds. If you are making a downwardly payment of 5% or 3% of the buy price, the lender will typically want to meet that the funds come from your own financial resources. That can include money withdrawn from a bank account, funds withdrawn or borrowed from an employer-sponsored retirement plan, or fifty-fifty the sale of a personal nugget.

Typically, once you lot satisfy the "own funds rule", the guidelines become more relaxed. For example, if you're making a x% down payment, the lender may require five% coming from your ain funds, and five% from a gift from a relative. But if the gift is equal to at least xx% of the purchase price of the property, the lender won't require you to show bear witness of your ain funds at all.

FHA loans have a more relaxed view of down payments entirely. Non but tin can the down payment come up from either your own funds or from a souvenir, merely they also allow loan gain from approved down payment assist programs. It can make information technology possible to become 100% financing on an FHA loan.

With VA loans, the downward payment isn't typically an issue. VA loans unremarkably provide 100% financing, which makes the downward payment a moot point.

Where you c an't g et down payment funds from

Ii by and large prohibited sources are cash and unsecured loans.

Past cash, I hateful currency you shop at home or in a safe. Any money yous invest into a home has to laissez passer through a fiscal institution to be considered a legitimate source of funds. In improver, cash savings in the form of currency can't be verified as being valid.

Unsecured loans are a no-get. If you take whatever ideas to provide a down payment from a credit card advance or the proceeds of a personal loan, this volition be rejected by the lender. Not only does information technology indicate an inability to accumulate funds for the downwardly payment, but it also creates an additional debt obligation.

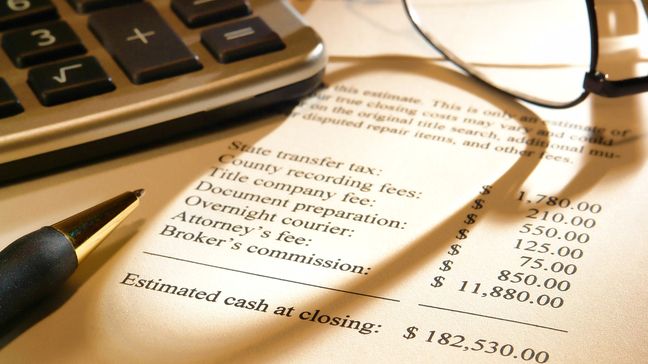

Endmost costs

This is where things showtime to get a footling complicated. This is because the cash outlay to brand the purchase becomes (often) much college than the downwardly payment solitary.

Closing costs may sew to 2%-3% of your loan amount

On a $200,000 mortgage, you'll need to come with between $4,000 and $6,000 in add-on to your down payment.

Endmost costs vary from i land to some other. This is due to differences in either the real estate transfer revenue enhancement, or mortgage "stamps" (government taxes collected based on a percentage of your mortgage loan amount). They can besides vary based on dissimilar rates charged for appraisals, attorneys, and fifty-fifty title insurance.

Closing costs tin as well vary from one lender to another, and even from 1 loan to another. For example, each lender charges a different application fee. In addition, lenders often charge "points" – so named because they represent a percent point of the loan amount.

An origination fee is i kind of point.The accuse will more often than not be betwixt 0.v% and 1% of the new mortgage corporeality. It represents compensation to the lender for placing the loan. Discount points are some other type. They represent points paid to lower the mortgage interest rate on a permanent basis.

For example, by paying a discount fee of 1% of the loan amount you take, you can reduce your mortgage involvement charge per unit by approximately 1/8 of i% (0.125%). However, if cash to close is an issue, paying discount points to lower the interest charge per unit isn't generally recommended. The small decrease in the monthly payment doesn't usually justify the cost of the discount points paid upfront.

Typical closing costs (other than origination fees and discount points)

Below is a list of common closing costs, including their purpose and a general price range. Non all volition be charged in every case, and there may be additional fees specific to your geographic location.

- Application fee – Not all lenders charge this fee, simply when they practise it ordinarily includes funds for both the appraisal fee and the credit report. It will by and large exist between $300 and $500 if it is charged.

- Appraisal fee – This is the fee the lender will pay to an independent appraiser to plant the market value of the holding you are purchasing or refinancing. It will generally be between $300 and $500 depending on the property and appraisal fees in your market area.

- Title search – This is a search done past a championship company to determine the beingness of any liens against the property. It's to ensure the property will transfer with a clear title. The cost of the search is typically betwixt $200 and $300.

- Title insurance – This insurance is purchased to cover whatever liens that may not have come out during the title search. You'll be required to take lender'due south title insurance to protect the lender against whatever undiscovered liens. Only it'southward strongly recommended that you besides get owner's championship insurance as well, which will protect you if such liens are discovered. With possessor's championship, you'll exist able to refinance your home or sell the property fifty-fifty if a prior lien is discovered. The cost of lender's title insurance is usually several hundred dollars, and is based on the value of the habitation. Owner's title is ordinarily around $200.

- Attorney fees – In many states, real manor closings are handled by title companies. But in others, they're customarily handled by attorneys. Await to pay betwixt $400 and $one,000 or more depending on the complexity of your transaction and your geographic location.

- Abode inspection – While an appraisal will be performed to establish the market value of the home, it does not address deficiencies with the property unless they are obvious. A home inspection is recommended – just not required – whenever you purchase a home. The cost volition more often than not be between $200 and $400. But it can exist coin well-spent if it identifies costly problems that you can have repaired by the seller prior to endmost.

- Real manor transfer and mortgage taxes – Many states impose taxes based on the value of the property being transferred or the amount of the mortgage, and sometimes both. Information technology will typically be a small percentage of the property value or the mortgage amount, and will vary by state and canton, and sometimes fifty-fifty by municipality.

There are actually two alternatives that can either reduce or completely eliminate closing costs:

- Negotiate for the seller to pay your closing costs – This will only be permissible in areas where this is common practice.

- Negotiate premium pricing with your lender – This is where you pay a higher interest rate on your mortgage in exchange for the lender paying the closing costs.

Either may be a adept option, specially if you lot are making a minimum down payment, like 5%, and adding closing costs on top would make your cash outlay significantly higher.

Prepaid expenses

These are probably the most disruptive charges for home buyers, but they are completely necessary. With almost mortgages, the lender will put real estate taxes and homeowner's insurance in escrow. This means that those charges will be included in your monthly payment, and paid by the lender when due.

In order for that to happen, the lender needs to collect certain amounts upfront, to ensure that the funds are available to make the payments when they are due. The escrow accounts are prepare to pay the charges on the next due date, while a portion of your monthly payment replenishes the escrow account for the due engagement after that.

Depending on where you lot alive, and the frequency of existent estate tax collections, the lender may have to put anywhere between 2 and 12 months of existent manor taxes in escrow. If the taxes on the house are $250 per month, and a vi-month escrow is required, that will translate to a prepaid expense of $1,500 at closing.

The aforementioned applies to insurance.

For homeowners insurance policies, y'all're typically required to prepay a one-year homeowners insurance policy on the house, plus an extra ii months of premium charges to the lender'due south escrow account. The lender may also escrow one or 2 months of premiums for PMI as well, if required. You can find the best insurance rates by going through Policygenius– they tin prove you a number of rates and y'all can hands compare and choose the best one for you.

Depending on where you live, prepaid expenses may come up to equally much as 2% of the loan amount.

Fortunately, you can accept some or all of the prepaid expenses paid for you past either the seller, or by premium pricing paid to the lender. A third option is to refuse the escrow arrangement by the lender. This volition require that yous make a downwards payment of at to the lowest degree 20%.

Utility adjustments

Utility adjustments can include a big number of charges. Luckily, they seldom come to more than than a few hundred dollars. They basically stand for utility costs paid past the belongings seller in accelerate.

For example, if a seller fills the heating oil tank just earlier the endmost, y'all'll be required to reimburse the seller for the unused oil. This will happen at the endmost table. Similar charges can be incurred if the seller has prepaid other utilities, such as h2o, sewer, or trash removal.

Still another expense that could require adjustment at closing are homeowners association fees. In many homeowners association neighborhoods, member fees are paid on an almanac basis. If the seller has paid the fee for the total year, and you're endmost on the house on March 31 – three months into the twelvemonth – you will be required to reimburse the seller for 9 months' worth of fees. There may as well exist a fee to the HOA to get started. They may call it a transfer fee or something similar. Basically, it's a lump sum upfront from the new homeowner to get into the HOA.

Lender-required "cash reserves"

This ane takes many homebuyers by surprise. It isn't a endmost expense, just lenders crave that yous have and so much greenbacks left in savings after all closing costs are paid.

Lenders have a cash reserve requirement to avoid a buyer "closing broke". They don't want you lot to end up in an early on-term default. This requirement ensures that the borrower will be able to make their payment during the first few months.

The nearly typical cash reserve requirement is two months. That means that you must have sufficient reserves to embrace your get-go 2 months of mortgage payments. So if your primary, involvement, taxes, and insurance (PITI) come to $1,500 per month, the reserve requirement will be $3,000.

These are non funds that must be deposited with the lender. But the lender must be able to verify that you will have the funds available in a liquid source. These include savings account, checking account, or money market fund – subsequently closing on the property. Generally speaking, they frown on using retirement assets for this purpose, since those funds cannot be hands liquidated.

Where to become mortgage financing to purchase your abode

Credible

A great place to start your search is Credible . Before you even outset shopping for a new habitation, you tin can find out how much of a mortgage you lot can afford and even go preapproved for that amount. Having a preapproval letter will help you gain the confidence of your real estate amanuensis and any homebuyers since they'll run into that you lot tin get a loan for the corporeality of the purchase.

What'southward neat about Credible is that with i quick preliminary awarding, you can get quotes from multiple lenders. That lets you compare rates to make sure you're getting the best interest rates and terms for your mortgage. If you like ane of the offers, y'all can go along to a more than extensive application.

Like Reali Loans, Apparent doesn't charge fees for its services. Any fees you'll pay will be to the lender you choose based on the quotes Apparent gives you.

Summary

If y'all are buying a home for $200,000 and need a x% down payment, the total amount of cash that you may need to provide or at least testify looks something similar this:

| Toll | How much you lot need to save | Corporeality needed in cash |

|---|---|---|

| Down payment | x% of $200,000 | $xx,000 |

| Closing costs | 2.5% of $180,000 | $four,500 |

| Prepaid expenses | 2% of $180,000 | $3,600 |

| Utility adjustments | Estimated | $500 |

| Cash reserves | $1,200 mortgage payment x 2 | $2,400 |

| Total cash required | $31,000 |

As you tin see, you could need more than 1.5 times your downwards payment to successfully shut on a firm.

That'due south why it's important to include the additional cash requirements in your domicile buying plans.

Read more than:

- What Percentage Of your Income Can Yous Afford For Mortgage Payments?

- Home Affordability Calculator

Related Tools

Save Your First - Or NEXT - $100,000

Sign Up for gratuitous weekly money tips to help you earn and save more than

Nosotros commit to never sharing or selling your personal data.

Source: https://www.moneyunder30.com/how-much-cash-do-you-really-need-to-buy-a-home

Posted by: williamsgrothe1954.blogspot.com

0 Response to "How Much Money Do I Need Saved To Buy A 300k House"

Post a Comment